- Home

- VAT Refund

VAT Refund

VAT Refund Services in UAE

Claiming Back What Your Business Deserves

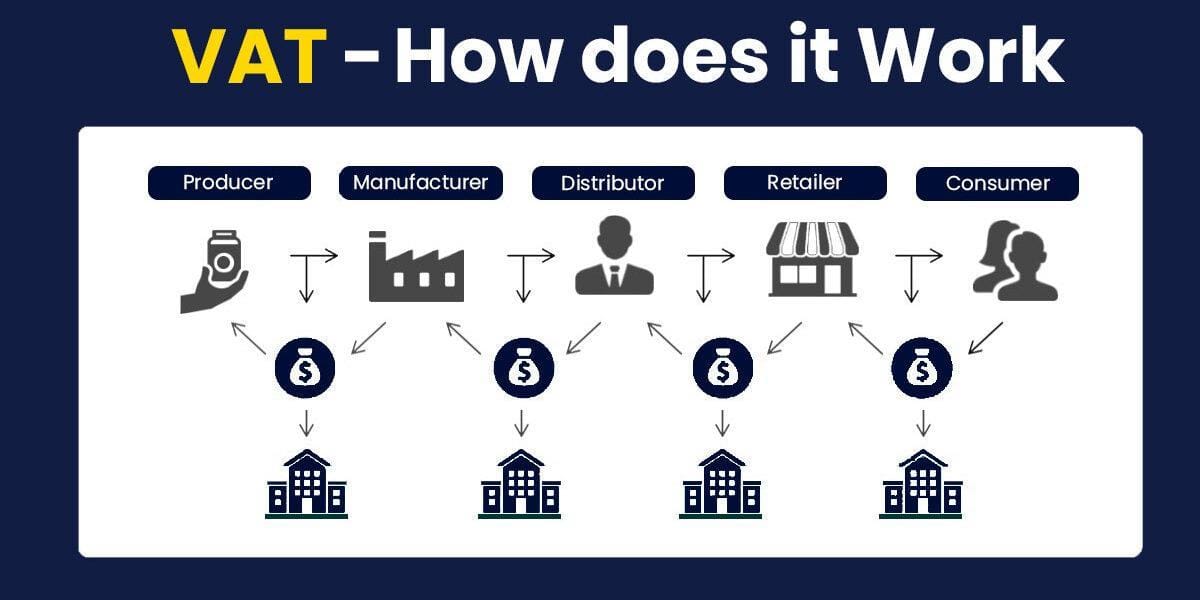

Under UAE VAT law, businesses are required to pay input VAT on purchases and collect output VAT on sales. In many cases, the VAT paid on purchases may exceed the VAT collected on sales, creating an excess input VAT balance. When this happens, businesses are eligible to apply for a VAT refund from the Federal Tax Authority (FTA).

At Navneet Accounting & Bookkeeping LLC, we provide professional VAT refund services in Dubai and across the UAE, helping businesses claim their refunds quickly and accurately. Our tax consultants handle the entire process—from preparing the refund application to liaising with the FTA—ensuring that your claim is compliant and processed without unnecessary delays.

Understanding Input VAT vs. Output VAT

Input VAT – The VAT a business pays when purchasing goods and services. For example, VAT on raw materials, utilities, or professional services.

Output VAT – The VAT a business collects from customers when selling goods or services.

If your input VAT exceeds your output VAT, your business is entitled to claim the difference back as a refund from the FTA. This is particularly common in industries with high operating costs, exporters with zero-rated supplies, or businesses in their early growth stages.

When Can You Apply for a VAT Refund?

A VAT refund may be claimed in several scenarios, including:

When input VAT consistently exceeds output VAT.

For businesses with zero-rated supplies (e.g., exporters).

After the closure of a business (upon final VAT return).

For certain government entities, charities, and international organizations eligible under FTA rules.

For tourists and visitors through the official Tourist Refund Scheme.

Options for Treating Excess Input VAT

When your business has excess input VAT, you have two options:

Request a Refund

Submit a refund application through the FTA portal to claim back the excess VAT.Carry Forward the Balance

Instead of claiming immediately, you may choose to carry forward the excess recoverable tax to future tax periods. This balance can be used to offset future VAT liabilities or penalties.

The choice depends on your cash flow needs, compliance strategy, and long-term tax planning.

The VAT Refund Process in UAE

The VAT refund process is completed online through the FTA’s Emaratax portal. The main steps are:

Prepare Documentation – Collect invoices, returns, and supporting evidence of excess input VAT.

File Refund Request – Submit the refund application via the FTA portal.

FTA Review – The FTA reviews the claim and may request additional documents or clarifications.

Refund Approval – Once approved, the excess VAT is refunded directly to the business’s bank account.

Timely and accurate filing is critical to avoid delays or rejection of the refund application.

Challenges Businesses Face in VAT Refunds

Many businesses struggle with VAT refunds due to:

Incomplete or incorrect documentation.

Misclassification of supplies.

Errors in VAT return filings.

Delayed responses to FTA queries.

These issues often lead to rejections, delays, or audits. Professional guidance ensures that your application is accurate, compliant, and supported by proper records.

Our VAT Refund Services

At Navneet Accounting & Bookkeeping LLC, we provide end-to-end support for VAT refunds, including:

Eligibility Assessment – Determining whether your business qualifies for a refund.

Document Preparation – Ensuring all invoices, returns, and records are in order.

FTA Portal Filing – Submitting accurate refund requests online.

Follow-Up with FTA – Handling clarifications and responding to queries.

Advisory on Carry Forward vs. Refund – Helping you decide the best approach for your business.

Compliance Review – Ensuring that your refund claim does not expose your business to penalties or audits.

Why Choose Navneet Accounting & Bookkeeping LLC?

Expertise in UAE VAT Law – Our consultants stay updated with the latest FTA guidelines.

Proven Experience – We have successfully assisted businesses across industries in securing VAT refunds.

End-to-End Service – From preparation to approval, we manage the entire process.

Accuracy and Compliance – Ensuring that every refund application is error-free and audit-ready.

Tailored Solutions – Customized support for SMEs, large corporations, and exporters.

Get Your VAT Refund with Confidence

VAT refunds can provide much-needed cash flow for businesses, but the process can be complex and time-sensitive. Errors or delays may lead to unnecessary financial strain and compliance risks.

At Navneet Accounting & Bookkeeping LLC, our tax experts simplify the VAT refund process, ensuring that your business gets back what it deserves—quickly, accurately, and in full compliance with UAE VAT law.

Contact us today to learn more about our VAT refund services in Dubai and across the UAE, and let us help you secure your refund with ease.